The TrAIn Bubble

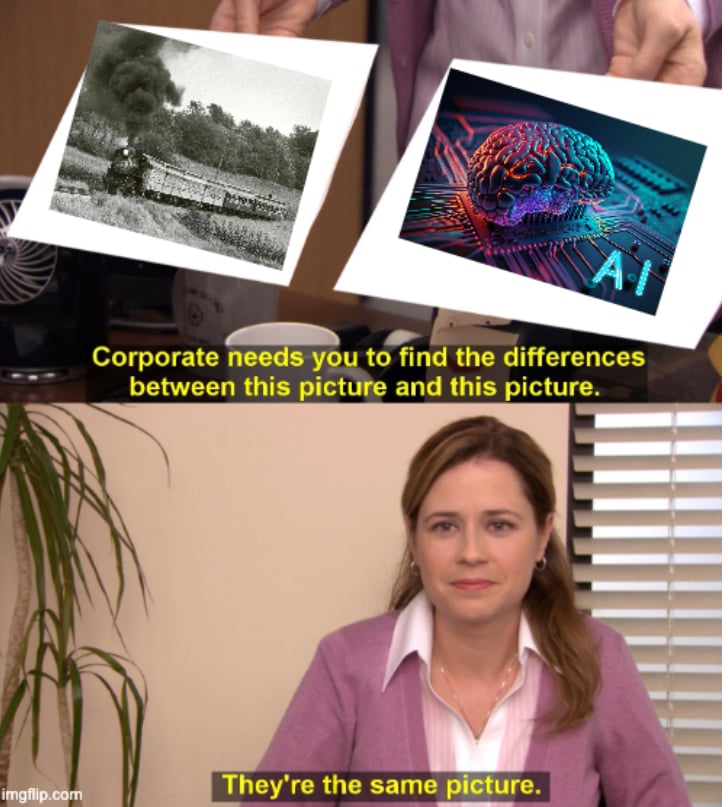

How today's AI maniac is bascially the same as the train boom of the 1860s

Bubbles: the things we play with as kids and worry about as Adults. They can create mass hysteria and mass fortune, bringing an economy to soaring heights and to hellish lows. Economic bubbles have existed throughout the centuries, from the tulip craze in the 17th-century Netherlands to the internet bubble of the 90s. Bubbles follow very similar patterns. There is a massive wave of investor hype for a few years (typically 3 to 5), followed by a fallout in some form, whether it's the failure of banks or companies or limited capital.

Every week for the past year, you have probably heard the words “AI Bubble” being thrown around by some Patagonia-wearing finance bro without much context surrounding it. I often hear that the current AI situation (or bubble, if you prefer) resembles the internet bubble of the late 90s and early 2000s, especially regarding the low profits of companies in both eras. While I don’t entirely disagree with this argument, I think that the current AI situation is actually very similar to the train bubble of the late 1860s. In all honesty, the real reason I want to talk about the train bubble is that my semi-neurodivergent self really just needed another reason to talk about trains (lol). But I promise I actually do have a real argument to back up my claim, let me cook for a moment and show you why the train bubble is important.

Section 1. The State Of AI

Before we begin to talk about trains (I know it is hard to wait when it comes to trains, so just hold on for a few minutes), let’s characterize the AI landscape. Now, in this article, I will not claim that AI is in a bubble (even though I do think it is), but draw historical bubble comparisons to help paint a bigger picture. Now that we got that all cleared up, let’s dive in!

According to Crunchbase data, roughly 50% of all current investment is going into AI, totaling $202.3 billion in 2025. American companies have taken most of this funding, yoinking 79% towards launching their AI applications. Apple, Microsoft, Alphabet, Amazon, Broadcom, and Meta now make up 32% of the entire U.S. stock market, a staggering figure that raises concerns about “Too Big to Fail” institutions in the economy. These big tech companies, which for the most part were already behemoths to begin with, have established themselves as some of the few profitable AI players in the market, with about $535 billion in net income between 2024 and 2025 across all six companies. While most of these companies are laying the groundwork for hardware and cloud innovations, they are individually investing billions into their own AI models.

However, on the other side of the spectrum are the pure-play AI startups. Companies like Anthropic, XAI, and OpenAI, whose sole business is just producing frontier models, have no profits whatsoever. OpenAI reported about $12 billion in losses in Q3 of 2025, and Anthropic had total losses of $5.3 billion in 2024, which is not stonks, if you ask me. Each time you use ChatGPT, whether in its free or pro tier, they are losing money to create that anime waifu picture you asked for (yeah, I’m talking to you, Redditors 👀). Anthropic estimates they will reach even cash flow by 2028 and OpenAI by 2030, but the same can’t be said for most AI startups in the game.

A report from MIT that was “popping off” in many major news and financial outlets a few months ago found that roughly 5% of all AI startups have some form of ROI, while the other 95% seem to be waddling around in the red. A CNBC article reported that roughly 1,500 startups have valuations of over $100 million, with about 500 valued at over $1 billion. If we are to take the MIT study to heart, and of course, we don’t know exactly the organizations they based these numbers on, we could make a naive prediction that roughly $142 billion in value could be lost if 95% of these 1300 companies do not become profitable. Now, it could be that these 1300 startups make up that 5% with real ROI, but I just wanted to visualize what could potentially be at stake.

But why are most of these companies struggling to actually make a profit? Well … this is mostly due to the infrastructure and compute costs to actually run and train these powerful models. These are executed across hundreds of thousands of GPUs for hours on end, running on very expensive hardware and racking up energy costs the provider needs to pay. Since most pureplay AI companies do not have data centers themselves (some, like OpenAI, are starting to), they are subject to the provider's costs, whether it's AWS, Google, or Meta. These data centers need to pay for all the energy used to power their systems (to generate your little anime friend), so the cost remains a consistent factor. Fun fact: a 2025 Pew Research study found that U.S. data centers' annual electricity consumption exceeded that of the entire nation of Pakistan (“this is a strong message”). Google, Microsoft, and other companies are now in the race to find a Nuclear Energy Solution to their cost nightmare.

It’s not just venture capital and corporations fueling the AI race, but the U.S government as well. Back in January, President Trump announced a 500 billion infrastructure plan with Nvidia, Oracle, and Softbank called Stargate. The goal of the plan is to aid in helping increase AI development in the U.S, particularly to help outpace China in the performance of AI models. While Stargate is being funded by the private sector, the government itself is investing heavily in AI applications. The U.S. Department of Defense (I refuse to call it the Department of War) requested $13.4 billion for AI and Autonomy funding in 2026, and in 2025 about $3.3 billion was invested in non-defense AI R&D. The government also acquired a 10% stake in Intel in August, and while the share buyout does seem rather dubious (maybe we devote another article to that), some see it as a larger U.S. investment to promote domestic chip making. Additionally, in July of 2025, Trump signed an executive order accelerating land acquisition for data centers, potentially allowing the use of Federal land, loans, and tax incentives for certain data center projects.

Section 2. Chu Chu, The Train Bubble Is Boarding

I’m sorry I had to drag you through that boring section about the “Current state of AI, blah blah blah”; we can finally talk about what we have all been waiting for: trains (you should be as happy as that train TikTok guy). Many of you might think I am crazy to talk about an obscure bubble from the 1800s, but trust me, once I provide evidence, I think you will be convinced as well.

During the Civil War, trains were changing the way battles were fought; supplies and troops were being shipped by rail, and battles were typically fought within a nearby radius of a rail line (many argue the train was one of the pivotal reasons the Union defeated the Confederacy). During the Civil War, the Union passed the Homestead Act on May 20, 1862, encouraging settlers to expand westward. Abraham Lincoln recognized that a transcontinental railroad, helping to link the economies of the West and the North, could not only accelerate the speed of settler expansion and the growth of the Union economy but also prevent other western states and territories from seceding from the Union and joining the Confederacy. Thus, in July of 1862, Congress passed the Pacific Railroad Act to create a rail line from the Missouri River to the Pacific Coast.

Congress designated two companies, the Union Pacific Railroad and the Central Pacific Railroad, as the primary builders of this project, assigning the Central Pacific to begin in California and the Union Pacific to begin near Nebraska. These companies were given massive government incentives to begin building rail lines. For every mile of track laid on level land, they were given $16,000; $32,000 for tracks in the foothills; and $48,000 for tracks laid in the mountains. In modern currency, this means the government was loaning about $513,460, $1,026,921, and $1,540,381.78 per mile in this region, respectively. These companies were also given massive land rights for the tracks they built, with about 12000 acres per mile of track. Now, these railroad companies, like the little goblins they were, recognized that their tracks would not become profitable for many years, so they created construction companies to inflate their building costs and make profits. Thus, they would typically try to build rail lines in areas where the government offered the most money, so their construction company could make as much as possible. This led to what was known as the Crédit Mobilier Scandal, uncovered in 1972, in which the Union Pacific was found to be bribing members of Congress and the vice president for favorable policies in exchange for railroad stock. While the Central Pacific may not have been implicated in this scandal, the “big four” founders of the Central Pacific made mass fortunes constructing the rail lines.

By 1865, the Civil War had ended, and with it came new room for new investment. Many, seeing the potential of the railroad and the profits the Union Pacific and Central Pacific construction companies were making, began heavily investing in railroad bonds and stock. New railroad companies were popping up all over the place, and estimates believe that by 1873, total investment in railroad stocks and bonds had reached $3.7 billion, or close to $1 trillion dollars in today’s standards. Not only were railroad companies investing large sums of capital, but so were raw-material producers, such as iron and steel producers, helping bring power to people like Vanderbilt and Carnegie. The Europeans, also wanting to get in on the action, heavily invested in the U.S., with historians estimating that foreign entities invested a total of $1.47 billion in 1869, accounting for about 19% of U.S. GDP (this $1.47 billion was in 1860s currency, btw).

This massive wave of excitement came to a halt in 1873. A stock market crash in Vienna, Austria, forced European Investors to withdraw their money from the U.S., where a large majority of it was invested in railroad companies. This led to panic in the U.S., triggering massive bank runs and withdrawals from the railroad industry. About 100 banks failed, 24% of railroads went bankrupt, and 18000 businesses closed, creating one of the largest depressions the world and the U.S. had seen. The railroad hype of the 1860s and 1870s had finally come to an end, with train construction resuming years later.

Section 3. Let’s Do A Little Side-by-Side

Now that we have a better understanding of trains (and I’m so happy I just got to write about them), let's come back to my main point at hand: why trains are similar to the AI situation. First, the creation of the train and steam engine was a revolutionary technology that fundamentally changed how businesses operated and how people came together in the 19th century. The same can almost be said about AI; it’s changing how quickly businesses can operate and lowering the barrier to entry for many small businesses as well.

Unlike the dotcom bubble, which was mostly software-based and fueled by venture capital, the AI and train boom was/are mainly focused on large government and private infrastructure investments. The government created the transcontinental railroad and offered land grants not only to fuel the economy but also to outcompete the Confederacy in the event of a long-lasting war. While not to the same extent as the 19th century, today’s government is offering land grants and loans to help propel AI within the economy and outcompete China and other foreign adversaries. Both governments saw the potential for national security and economic booms in this new technology. While not at the same level as the 1870s, foreign investment is accounting for a large share of AI startups. A report from CSET found that roughly 24% of funding from AI startups comes from investors outside the U.S., with prominent examples including Luma AI raising $900 million from a Saudi-based firm and Antropic raising $1.5 billion from Singapore's GIC.

Thinking about the railroad companies themselves seems almost like a copy-and-paste of today’s companies. NVIDIA and Intel could be seen as the Iron and steel suppliers for the Railroad companies, making fortunes off the need to run AI. Companies like Google, Meta, and Microsoft are the railroad companies building up the infrastructure necessary to run the train. Anthropic and OpenAI are the steam engines, finding ways to increase the speed and efficiency at which their models run on their hardware (or the railroad itself in this analogy). All of these companies are offering the same promise as the railroad: unity, economic prosperity, new markets, and increased efficiency. The message and the funding needed to build both seem closely aligned when viewed side by side.

While rampant corruption was another factor in the U.S. train boom, there is also speculation that it is becoming a more significant factor in the AI boom. Many CEOs of AI companies donated large sums to Trump's Inauguration, with prominent figures like Tim Cook and Sam Altman each donating over $1 million, according to Open Secrets. While there is no current Scandal like Crédit Mobilier, it is worth noting as AI deals move forward. If the Trump Administration is reading this, please note that I did not claim there was corruption; I merely speculated on corruption, so you cannot sue me for defamation .

While the similarities are quite staggering, there are some important considerations to note. One is that the entire economic structure during the 1870s was fundamentally different from today. The U.S. relied on the National Banking system rather than the Federal Reserve, creating the problem of large bank runs. Actually, the Federal Reserve was created because a panic similar to the one in 1873 occurred about every decade. The Global economy is also fundamentally different from what it was 150 years ago. While the U.S and Europe were the economic powerhouses due to colonization and suppression during that time, more countries, especially those in Asia and the Middle East, are contributing more to the global economy than ever before.

Section 4. Wrapping it up

I hope my little train rant opened your eyes to the many similarities between the train bubble and the AI boom currently underway. While the U.S. financial system is much more stable than it was 150 years ago, it is still important to examine how history has handled mass infrastructure investment and spending. With limited government oversight and massive government and private investment, companies extorted the public to extract as much value as possible, enriching themselves while leaving others in the dust. While I think AI will have a massive impact moving forward (just like trains), keeping history fresh in our mind is the best way to prevent further missteps and economic crashes during this boom.

Receipts

- https://www.dunham.com/FA/Blog/Posts/debt-cycles-history-bubbles-crashes#:~:text=The%20Railway%20Mania%20(1860s%2D1880s,rushed%20and%20routes%20became%20redundant.

- https://www.investopedia.com/terms/d/dotcom-bubble.asp

- https://www.federalreservehistory.org/essays/banking-panics-of-the-gilded-age?ref=dunham.ghost.io

- https://www.investopedia.com/the-u-s-economy-is-putting-all-its-chips-down-on-a-i-11841060#:~:text=Key%20Takeaways,that%20power%20the%20AI%20expansion.

- https://hbr.org/2025/11/ai-companies-dont-have-a-profitable-business-model-does-that-matter

- https://www.microsoft.com/investor/reports/ar25/index.html

- https://www.macrotrends.net/stocks/charts/GOOGL/alphabet/net-income

- https://www.macrotrends.net/stocks/charts/NVDA/nvidia/net-income

- https://medium.com/@shaikharbaz077/the-ai-pricing-crisis-why-95-of-companies-are-losing-money-and-only-cash-rich-giants-will-survive-14d51d686f05

- https://www.cnbc.com/2025/10/21/are-we-in-an-ai-bubble.html

- https://www.pewresearch.org/short-reads/2025/10/24/what-we-know-about-energy-use-at-us-data-centers-amid-the-ai-boom/

- https://www.reuters.com/technology/artificial-intelligence/trump-announce-private-sector-ai-infrastructure-investment-cbs-reports-2025-01-21/

- https://ccsglobaltech.com/federal-contractors-defense-ai-strategy/

- https://www.whitehouse.gov/presidential-actions/2025/07/accelerating-federal-permitting-of-data-center-infrastructure/

- https://www.library.hbs.edu/hc/crises/1873.html#:~:text=The%20Panic%20of%201873%20originated,line%20had%20already%20been%20completed.

- https://www.fabricatedknowledge.com/p/lessons-from-history-the-great-railroad

- https://www.youtube.com/watch?v=rUmD0jFTnCA

- https://www.battlefields.org/learn/articles/transcontinental-railroad

- https://enotrans.org/article/ulysses-s-grant-1869-1877-panic-of-the-railroads/#:~:text=On%20September%2020th%201873,reached%20a%20shocking%2014%20percent.

- https://www.gilderlehrman.org/history-resources/essays/financing-transcontinental-railroad

- https://billofrightsinstitute.org/essays/the-transcontinental-railroad

- https://faroutliers.com/2022/05/13/railroad-boom-and-panic-1870s/?utm_source=chatgpt.com

- https://home.treasury.gov/about/history/freedmans-bank-building/financial-panic-of-1873#:~:text=Railroad%20companies%20borrowed%20using%20bonds,Many%20railroads%20went%20bankrupt.

- https://www.federalreserve.gov/econres/notes/feds-notes/foreign-portfolio-investment-when-the-united-states-was-an-emerging-market-20191016.html

- https://www.youtube.com/watch?v=AXLcRbLRues

- https://www.youtube.com/watch?v=ZDp5dihD6tk

- https://www.cnbc.com/2025/11/19/luma-ai-raises-900-million-in-funding-led-by-saudi-ai-firm-humain.html

You earned +200 XP for reading this article!